s corp tax calculator nyc

This could potentially increase the S-corp tax bill significantly and essentially wipe out the other tax advantages offered by this entity structure. The SE tax rate for business owners is 153 tax of the first 142800 of income and 29 of everything over 142800.

When Is The Best Time To Convert To An S Corp Taxhub

9 hours agoMay 16 2022 7 min.

. This is known as the new york city unincorporated business tax ubt. Form IT-2658 is used by partnerships and S corporations to report and pay. If you live in New York City youre going to face a heavier tax burden compared to taxpayers who live elsewhere.

However if you elect to be taxed as an S-Corporation and take a 40000 salary with the remaining 30000 being a distribution to you or you keep it in the business you pay only. S-corporations are exempt from the Business Corporate Tax but they are still subject to the General Corporation Tax or Banking Corporation Tax. Annual state LLC S-Corp registration fees.

State tax rates on personal income range from 4 to 109. S-Corp or LLC making 2553 election. Payments due April 18 June 15 September 15 2022 and January 17 2023.

S Corp Tax Calculator - Llc Vs C Corp Vs S Corp. It doesnt have to be this way. This tax is also known as the FICA Medicare or social security tax and is levied on your entire income.

Now if 50 of those 75 in expenses was related to meals and. Lets start significantly lowering your tax bill now. Publicly traded partnerships that were subject to the City Unincorporated Business Tax in 1995 and made a one-time election not to be treated as a corporation and instead to continue to be subject to the Unincorporated Business.

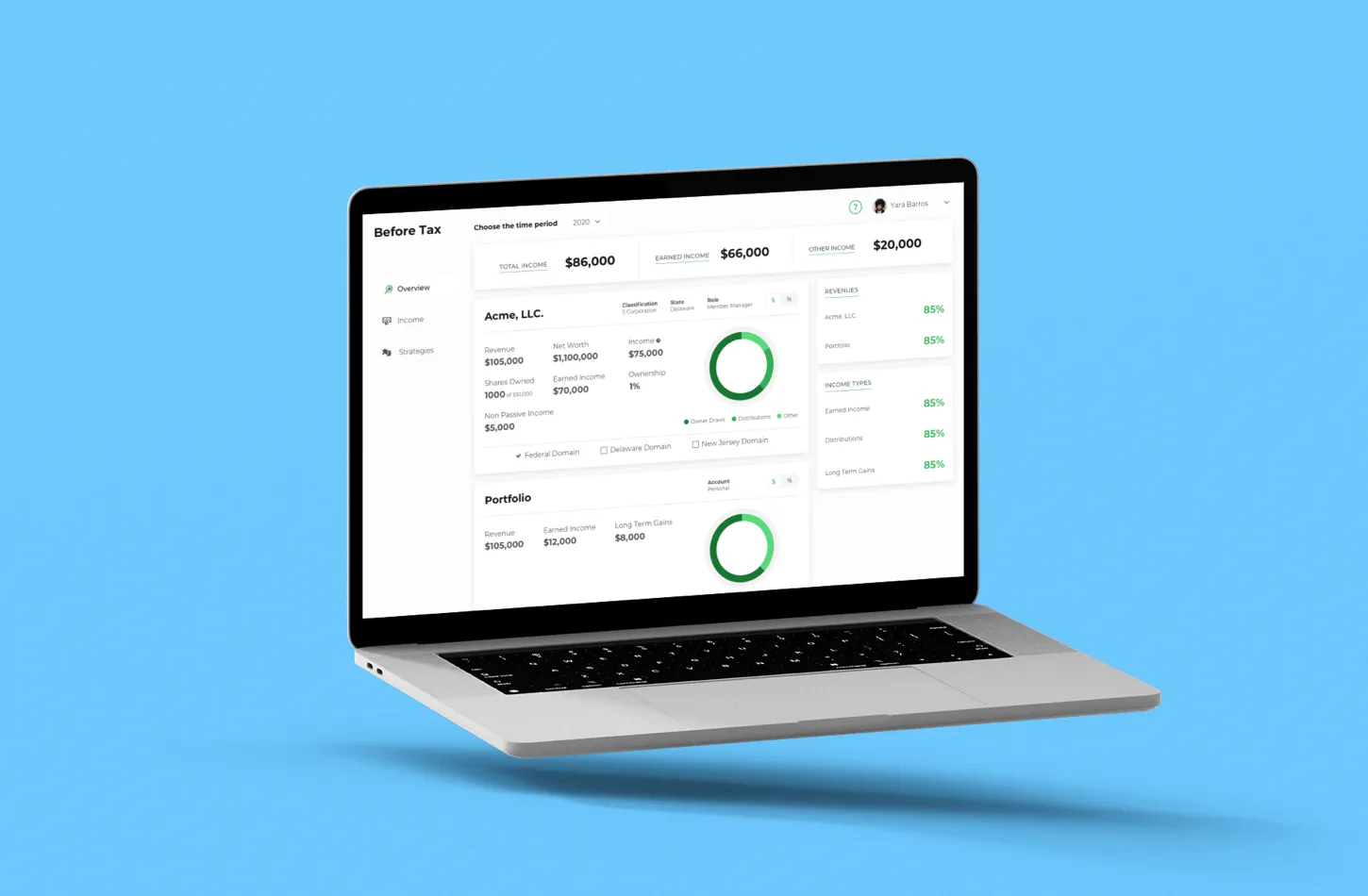

Entity Taxation Calculator - LLCs vs. If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax. The citys tax rates range from 3078 of taxable income to 3876 for top earners.

S corp tax calculator nyc Thursday February 10 2022 Edit. 900am 500pm Wednesday. C-Corp or LLC making 8832 election.

From the authors of Limited Liability Companies for Dummies. Description of Form IT-2658. 900am 500pm Tuesday.

For example if you have a business that earns 200 in revenue and has 75 in expenses then your taxable income is 125. Annual cost of administering a payroll. Normally these taxes are withheld by your employer.

Tax calculator based on 2018 Tax Law. We are not the biggest firm but we will work with you hand-in-hand. This allows owners to pay less in self.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. New York has a 4 statewide sales tax rate but also has 640 local tax jurisdictions. For example if you pay yourself.

Forming an S-corporation can help save taxes. Reduce your federal self-employment tax by electing to be treated as an S-Corporation. We are not the biggest firm but we will work with you hand-in-hand.

You can use our New York Sales Tax Calculator to look up sales tax rates in New York by address zip code. The passage of the 2021. Estimated Local Business tax.

If you are self-employed you have to pay both the employer and employee portion which was 153 in 2016. The net income from the S corporation passes through to the business owners and New York also taxes this income. Forming an S-corporation can help save taxes.

IT-2658 Fill-in 2022 IT-2658-I Instructions Report of Estimated Tax for Nonresident Individual Partners and Shareholders. As ceo and founder of carls sandwiches you earned a 60000 salary in 2019 and the company also earned a net profit of 200000 that year which youre entitled to 50 ofor 100000. These corporations will continue to file GCT tax returns in tax years beginning on or after January 1 2015 if they are.

Effective for tax years beginning on or after January 1 2015 the general corporation tax GCT only applies to subchapter S corporations and qualified subchapter S subsidiaries under the US. If your business is incorporated in New York State or does. New York NY 10002.

If your business is incorporated in New York State or does business or participates in certain other activities in New York State you may have to file an annual New York State corporation tax return to pay a franchise tax under the New York State Tax Law. There isnt a specific S corporation S Corp tax rate because S corp income isnt taxed at the business level. Total first year cost of S-Corp.

Login Email Password. Yonkers also levies local income tax. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

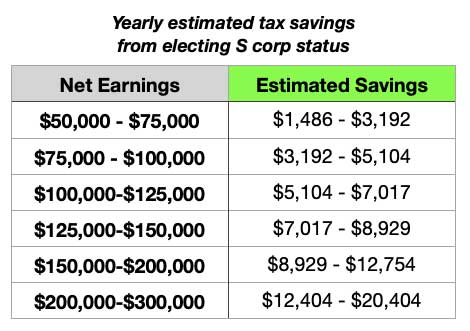

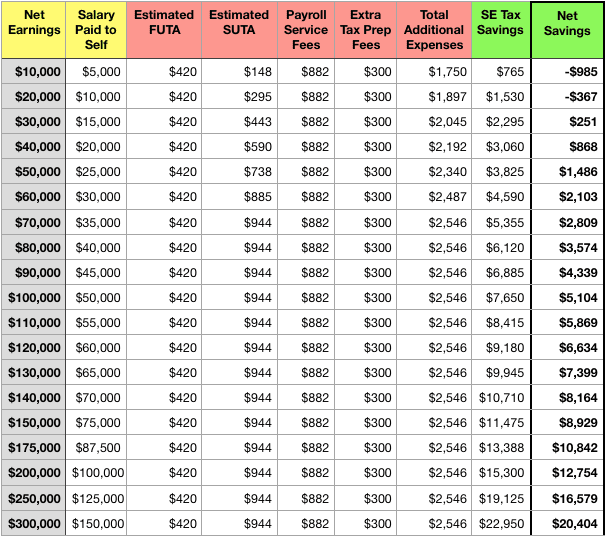

This calculator helps you estimate your potential savings. Total first year cost of. Tax Bracket gross taxable income Tax Rate 0.

This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. 3078 - 3876 in addition to state tax Sales tax. But as an S corporation you would only owe self-employment tax on the 60000 in.

S corp tax calculator nyc. Residents pay 1675 of their net state tax while non-residents pay 05 of. Information on this page relates to a tax year that began on or after January 1 2021 and before January 1 2022.

If you are a qualifying manufacturer you will have a cap of 350000. Thats because NYC imposes an additional local income tax. Use this calculator to get started and uncover the tax savings youll receive as an S Corporation.

Being Taxed as an S-Corp Versus LLC. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. S corp tax calculator nyc Thursday February 10 2022 Edit.

16 How Real Estate Agents Flippers And Wholesalers Save Thousands In Taxes With S Corps

Here S How Much You Ll Save In Taxes With An S Corp Hint It S A Lot

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Federal Income Tax Deadline In 2022 Smartasset

New York State Pass Through Entity Tax Sciarabba Walker Co Llp

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

Student Information Card Template New Frozen Bank Accounts New Economy Project Best Templates Ideas Bes Credit Card Online Bank Account Student Information

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

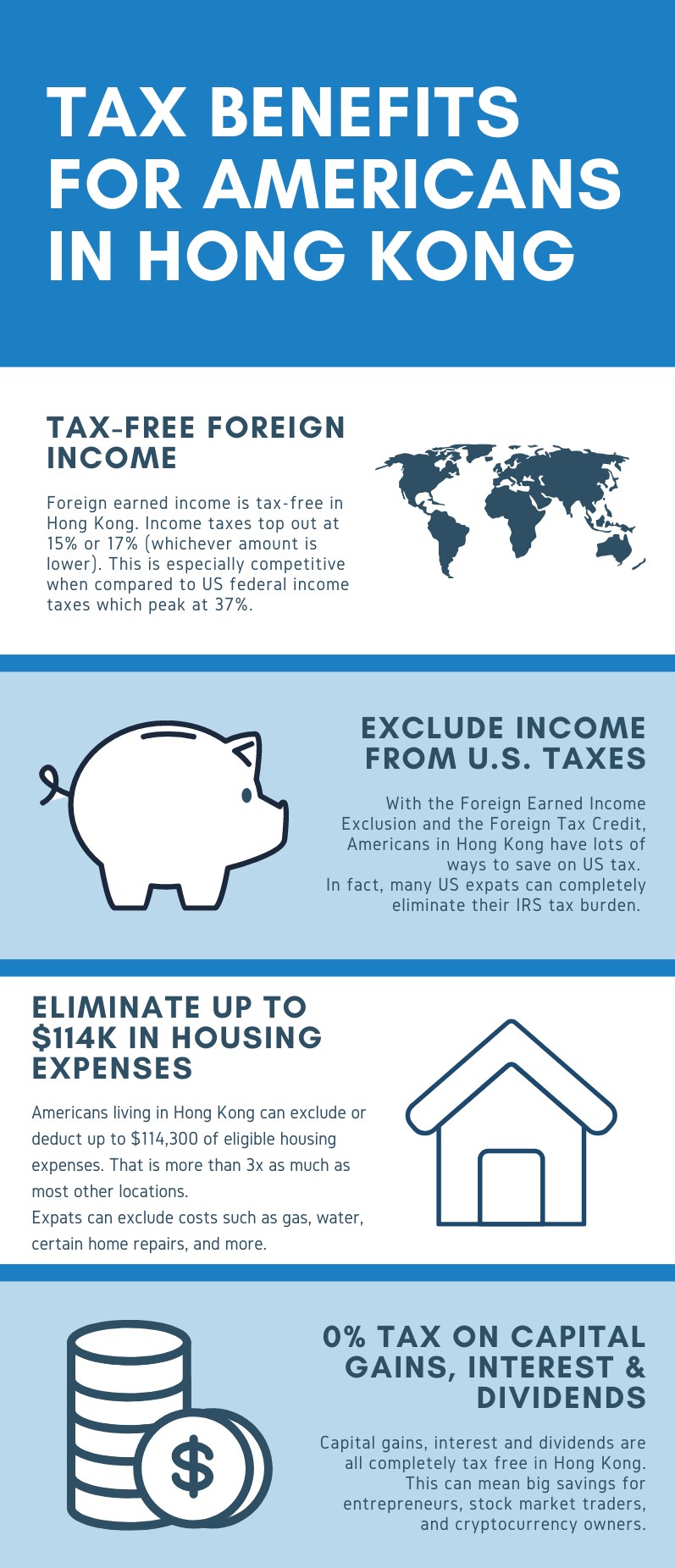

Americans In Hong Kong 12 Things To Know About Tax Online Taxman

Here S How Much You Ll Save In Taxes With An S Corp Hint It S A Lot

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

New York State Enacts Tax Increases In Budget Grant Thornton

S Corp Tax Savings Calculator Newway Accounting

Right Of First Refusal Work In Nyc Hauseit Right Of First Refusal Buying A Condo Nyc

Taxes For Freelance Developers How Much Tax You Should Pay As A Freelancer